For both resident and non-resident companies corporate income tax CIT is imposed. Income Tax Withholding Tables.

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

The corporate tax rate for small and medium enterprises SMEs will be reduced to 17 this year from 18 previously.

. 20182019 Malaysian Tax Booklet 7 Scope of. And simplified tax investment incentives that would be. Tax Rate of Company.

Rate Tax RM 0 - 5000. Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than. Income tax rates.

Income Tax Rates and Thresholds Annual Tax Rate. Tax Rate of Company. Tax Rate of Company.

Company non-citizen and non-permanent resident individual increased from 5 to 10. Corporate - Taxes on corporate income. A place of business as defined in Malaysia is also deemed derived from Malaysia wef the date the relevant law comes into effect.

20182019 Malaysian Tax Booklet 22 Rates of tax 1. Malaysian citizen or permanent resident increased from 0 to 5. On the First 5000.

The increased tax rate. 20182019 Malaysian Tax Booklet 22. Dari luar Malaysia bagi syarikat insurans pengangkutan laut dan udara dan perbankan sahaja.

Modal berbayar sehingga RM25. Malaysia Non-Residents Income Tax Tables in 2019. For both resident and non-resident companies corporate income tax CIT is imposed on income.

Company Tax Rate 2018 Malaysia Table. Answering yes to reasons listed above means that it is compulsory for you to file your income tax in Malaysia. Tax Rate of Company.

On the First 35000 Next 15000. The standard Malaysia corporate tax rate is of 24 for the financial year of 2019-2020 this rate being applied to both resident companies and to non-resident companies. Tax Rate of Company.

Last reviewed - 13 June 2022. Company with paid up capital not more than RM25 million. 20182019 Malaysian Tax Booklet 7 Scope of.

Resident individuals Chargeable income RM YA 20182019 Tax RM on excess 5000 0 1 20000 150 3 35000 600 8 50000 1800. Malaysia Corporate Income Tax Rate. Tax Rate of Company.

Tax Booklet Income Tax. It is Necessary to Be Aware of the Malaysia Corporate Tax Rate 2019 Because It is a Factor in the. The deadline for filing income tax in Malaysia is 30 April 2019 for manual filing and 15 May 2019 via e-Filing.

Rates Real Property Gains Tax Stamp Duty Sales Tax Service Tax Other Duties Important Filing Furnishing Date. Company Taxpayer Responsibilities. Rate TaxRM A.

On the First 5000 Next 15000.

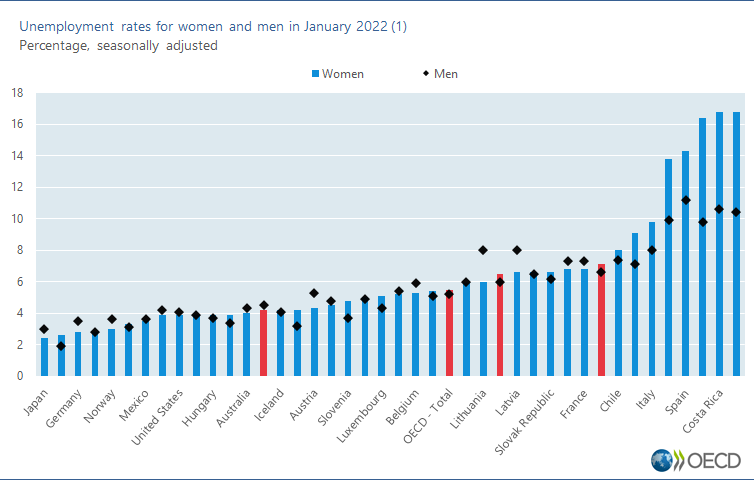

Unemployment Rates Oecd Updated March 2022 Oecd

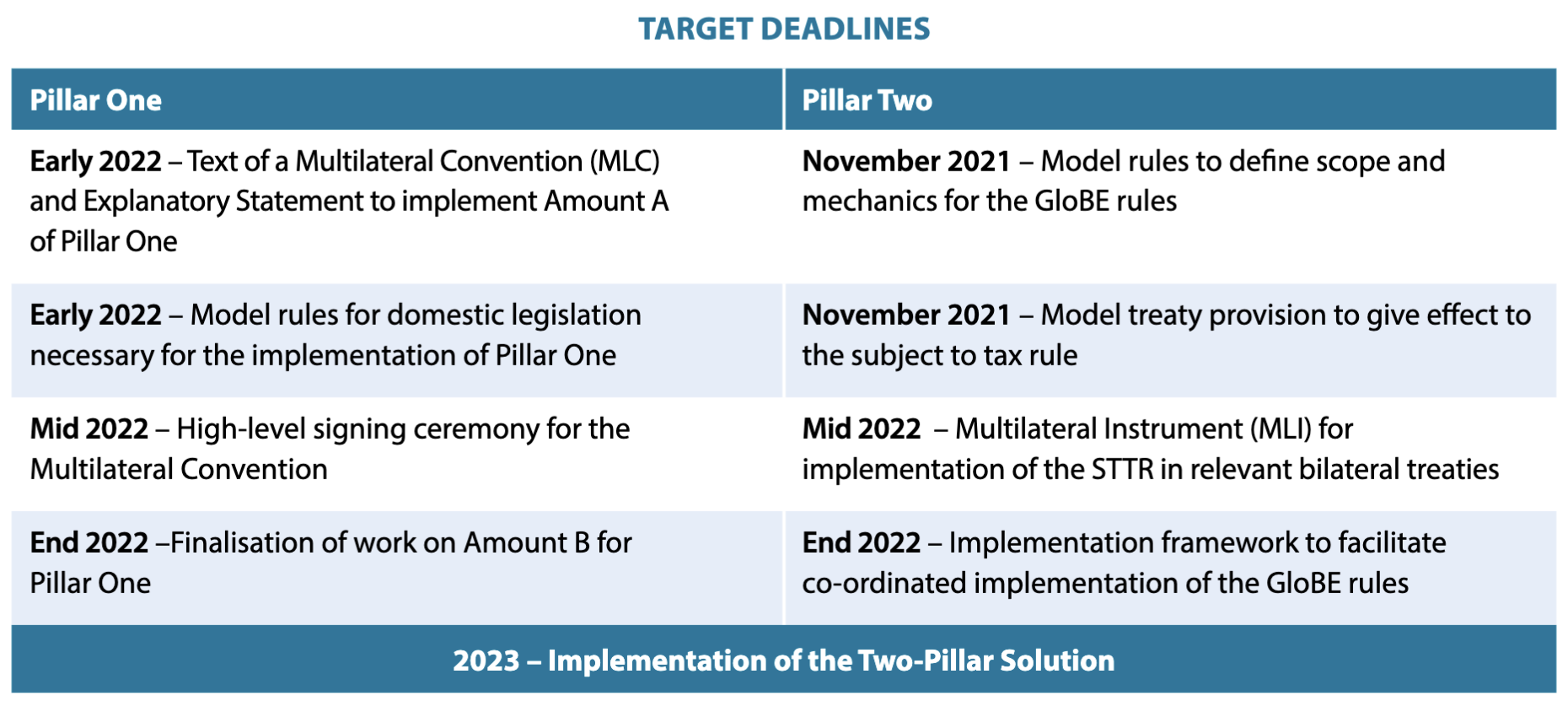

Digital Taxation In 2022 Digital Watch Observatory

Tax Rates Of Nordic Countries World Europe And Oecd Countries 4 Download Scientific Diagram

Company Tax Rates 2022 Atotaxrates Info

2022 年大马报税需知 纳税人税率 Kadar Cukai 及如何计算税金 Map Screenshot Map Periodic Table

Income Tax Formula Excel University

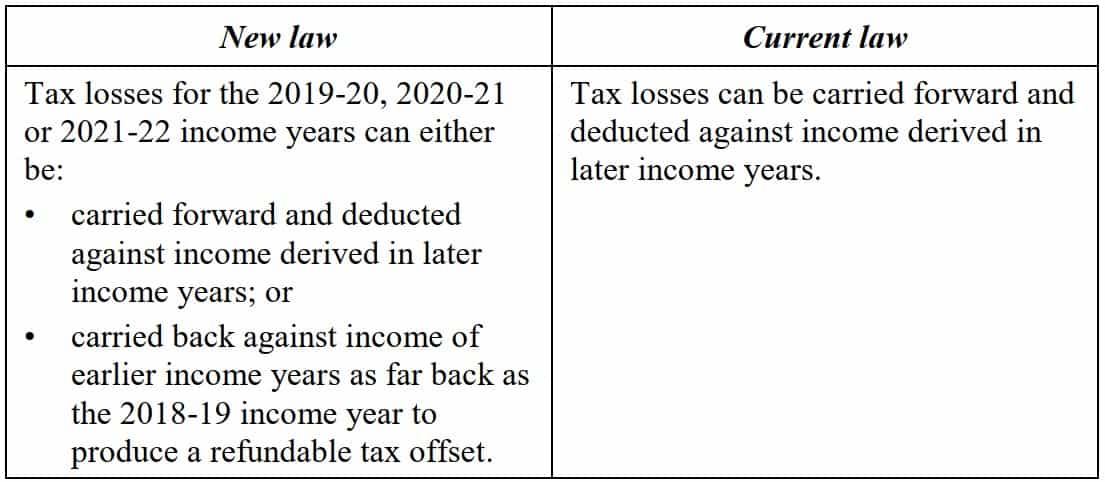

Company Tax Rates 2022 Atotaxrates Info

How To Calculate Your Income Tax Step By Step Guide For Income Tax Calculation Youtube

The Crux Co Cake Brochure On Behance Brochure Menu Layout Menu Design

Carbon Taxes Worldwide By Country 2022 Statista

Dutch Corporate Income Tax Rate Increase For Fy 2022 Kpmg Netherlands

Recent Changes To Income Tax D L F De Saram

Corporate Income Tax Cit Rates

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

Individual And Corporate Tax Reform

Work From Resort Resort Packages Resort Golf Resort

Recent Changes To Income Tax D L F De Saram

/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)